Table of Contents

- Australian income tax brackets and rates (2024-25 and previous years)

- Tax Brackets 2024 Australia Ato - Laina Justine

- 2024 Tax Brackets Australia Ato - Hatty Kordula

- Ato Tax Rates 2024 Australia - Printable Online

- Tax Brackets Australia 2024-25 - Wally Malvina

- Tax Rates 2024-25 Ato - Jolie Madelyn

- Australian Income Tax Rates 2024-25 - Rafa Ursola

- Income Tax Rates Australia 2024 - 2024 Company Salaries

- Australian Income Tax Rates 2024-25 - Rafa Ursola

- 2024 Tax Brackets Australia Ato - Dawn Mollee

In this article, we'll break down the key tax rates and tables for the 2024-25 financial year, covering individual tax rates, company tax rates, and other essential information. Whether you're an individual, business owner, or financial advisor, this guide will help you navigate the complexities of the Australian tax system.

Individual Tax Rates 2024-25

- 19% on taxable income between $18,201 and $45,000

- 32.5% on taxable income between $45,001 and $120,000

- 37% on taxable income between $120,001 and $180,000

- 45% on taxable income above $180,000

Company Tax Rates 2024-25

Other Essential Tax Rates and Tables

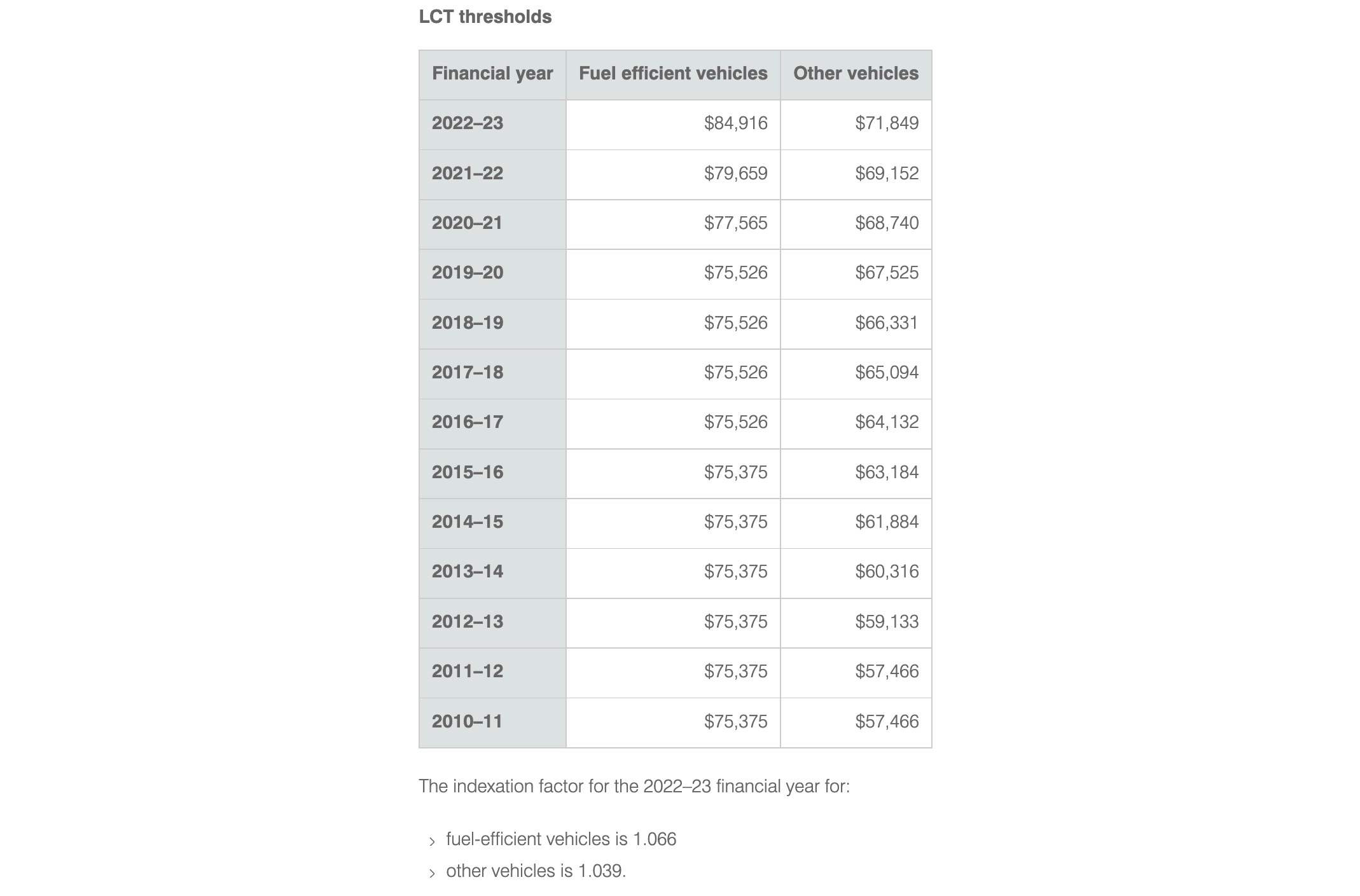

In addition to individual and company tax rates, the PDF 2024-25 Desktop Tax Rates and Tables from Hall Chadwick also covers other essential tax information, including:- Fringe Benefits Tax (FBT) rates and thresholds

- Goods and Services Tax (GST) rates and thresholds

- Pay As You Go (PAYG) withholding rates and thresholds

- Superannuation guarantee rates and thresholds

Download the PDF 2024-25 Desktop Tax Rates and Tables from Hall Chadwick today and stay ahead of the curve when it comes to your tax obligations.

Note: The information contained in this article is general in nature and should not be relied upon as professional advice. It's always best to consult with a qualified tax professional or financial advisor to ensure you're meeting your specific tax obligations.